Featured

Table of Contents

Keeping all of these acronyms and insurance policy types right can be a frustration. The complying with table positions them side-by-side so you can swiftly separate among them if you obtain perplexed. An additional insurance protection kind that can pay off your mortgage if you pass away is a conventional life insurance coverage plan

A is in place for an established number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away during that term. A supplies insurance coverage for your whole life span and pays out when you pass away.

One usual guideline is to intend for a life insurance plan that will pay approximately ten times the insurance holder's salary quantity. Alternatively, you could pick to utilize something like the DIME approach, which includes a household's financial obligation, earnings, mortgage and education and learning costs to determine just how much life insurance coverage is needed (mortgage protection insurance services reviews).

It's additionally worth noting that there are age-related restrictions and limits imposed by virtually all insurance firms, who typically will not give older buyers as several alternatives, will bill them a lot more or may deny them outright.

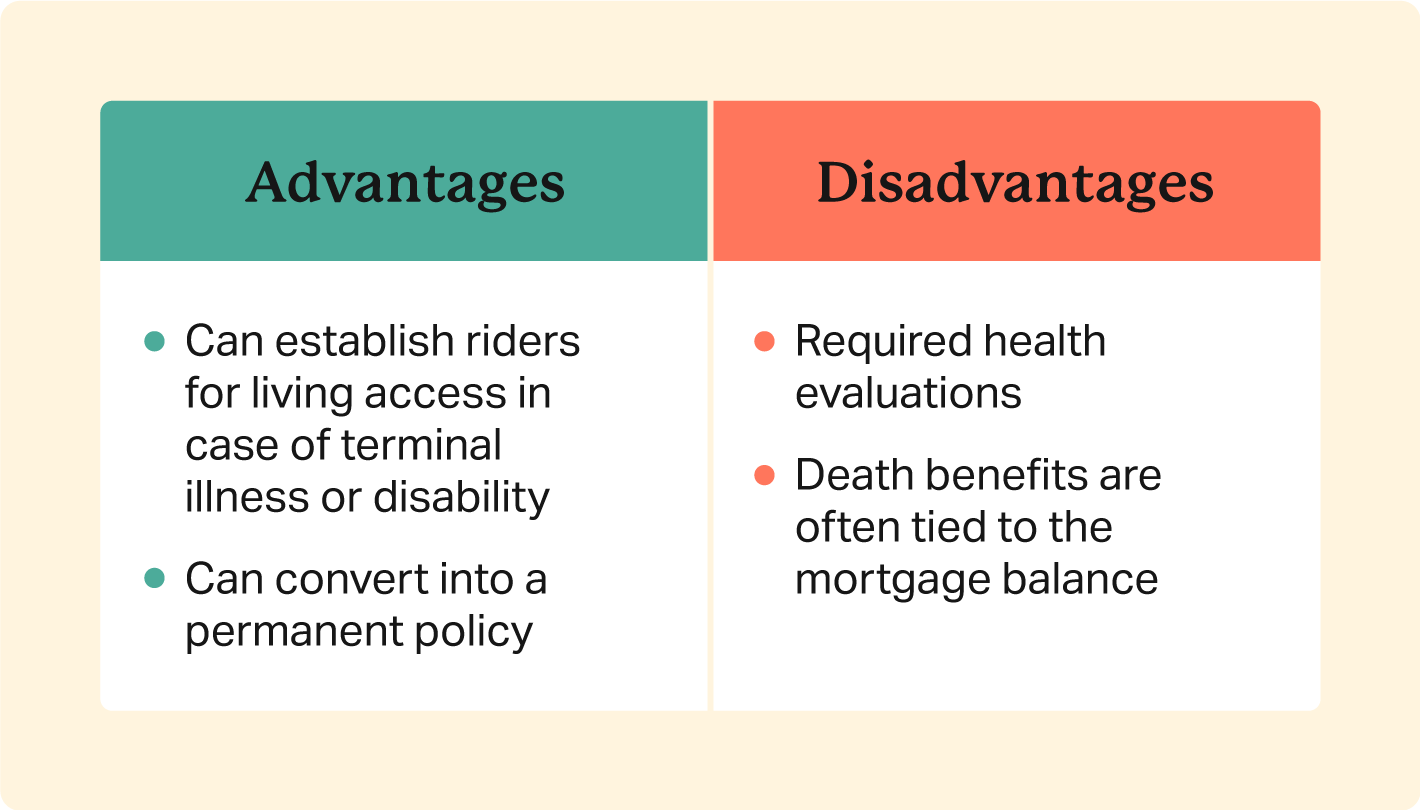

Below's just how mortgage protection insurance policy determines up versus conventional life insurance coverage. If you're able to qualify for term life insurance coverage, you ought to stay clear of home mortgage protection insurance policy (MPI).

In those scenarios, MPI can supply fantastic satisfaction. Simply make sure to comparison-shop and check out every one of the great print prior to signing up for any kind of policy. Every home loan defense alternative will certainly have many rules, regulations, advantage alternatives and disadvantages that need to be weighed meticulously versus your specific situation (mortgage insurance broker).

Decreasing Term Mortgage Insurance

A life insurance coverage policy can help repay your home's home loan if you were to pass away. It is among several manner ins which life insurance policy may help safeguard your loved ones and their economic future. Among the finest methods to factor your home mortgage right into your life insurance policy demand is to speak with your insurance policy representative.

Rather than a one-size-fits-all life insurance policy policy, American Domesticity Insurance policy Company uses policies that can be designed particularly to satisfy your family members's requirements. Here are some of your options: A term life insurance coverage plan. should i take out mortgage protection insurance is active for a particular amount of time and commonly offers a larger quantity of coverage at a lower rate than an irreversible policy

Rather than just covering an established number of years, it can cover you for your whole life. It likewise has living benefits, such as money worth buildup. * American Family Members Life Insurance policy Company offers different life insurance policy plans.

Your representative is a great source to address your questions. They may also have the ability to aid you find voids in your life insurance policy protection or new means to save money on your various other insurance policy plans. ***Yes. A life insurance recipient can choose to utilize the death advantage for anything - mortgage insurance program. It's a great means to assist secure the economic future of your family members if you were to die.

Life insurance policy is one way of assisting your family in paying off a mortgage if you were to pass away before the home mortgage is entirely paid back. Life insurance coverage earnings might be made use of to assist pay off a home mortgage, however it is not the exact same as home mortgage insurance that you might be needed to have as a problem of a lending.

Mortgage Insurance For Seniors

Life insurance policy may help guarantee your house stays in your family members by giving a fatality benefit that may help pay down a home mortgage or make essential acquisitions if you were to pass away. This is a short summary of coverage and is subject to plan and/or motorcyclist terms and problems, which may differ by state.

Words life time, lifelong and permanent undergo plan terms and problems. * Any kind of financings drawn from your life insurance policy plan will accrue rate of interest. mortgage payment protection redundancy. Any type of superior loan balance (finance plus rate of interest) will be subtracted from the survivor benefit at the time of claim or from the money value at the time of abandonment

Price cuts do not apply to the life plan. Policy Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

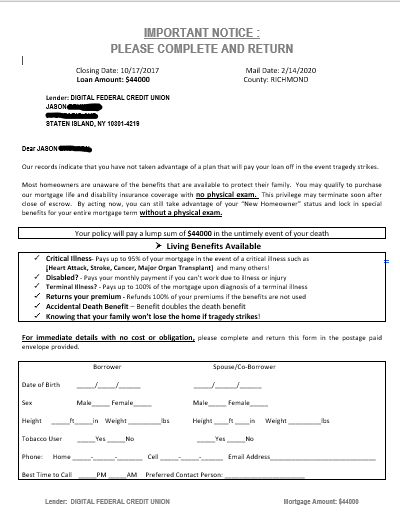

Home mortgage defense insurance policy (MPI) is a different sort of guard that could be helpful if you're incapable to repay your home mortgage. While that additional security seems good, MPI isn't for every person. Here's when mortgage security insurance policy deserves it. Home loan security insurance policy is an insurance plan that settles the rest of your mortgage if you pass away or if you become impaired and can not function.

Like PMI, MIP safeguards the lender, not you. Unlike PMI, you'll pay MIP for the period of the car loan term. Both PMI and MIP are required insurance protections. An MPI policy is completely optional. The amount you'll spend for home loan security insurance coverage relies on a selection of elements, consisting of the insurance company and the existing balance of your mortgage.

Still, there are pros and cons: A lot of MPI plans are provided on a "ensured acceptance" basis. That can be helpful if you have a wellness problem and pay high rates permanently insurance policy or battle to acquire protection. insurance mortgage protection provider. An MPI policy can give you and your family with a complacency

Mortgage Insurance Co

You can pick whether you need mortgage defense insurance coverage and for exactly how lengthy you require it. You could desire your home mortgage defense insurance coverage term to be close in size to how long you have left to pay off your home mortgage You can cancel a home mortgage defense insurance coverage policy.

Latest Posts

End Of Life Burial Insurance

Funeral Cover For Senior Citizens

Open Care Final Expense